- Home

- Institutional

- Our Products

Real Estate

- Assets

- Newsroom

Real Estate

Share Price: R$ 0,00

Intraday Variation: 0,00%

Source: Enfoque

Delay: 15min

Share Price: R$ 0,00

Variation: 0,00%

Source: Enfoque

Delay: 15min

Asset Basket

Historical NAV

Portfolio Holdings

*Equity REITs as established by FTSE’s Industry Classification Benchmark (ICB). For more information, please refer to the index provider’s website.

Total Return

Top 10 Holdings

| SECURITY | WEIGHT |

|---|---|

| XP Malls FII (XPML11) | 9,55% |

| Pátria Log FII (HGLG11) | 8,32% |

| BTG Pactual Logística FII (BTLG11) | 7,78% |

| Kinea Renda Imobiliária FII (KNRI11) | 6,70% |

| XP Log FII (XPLG11) | 5,09% |

| TRX Real Estate FII (TRXF11) | 4,87% |

| Vinci Shopping Centers FII (VISC11) | 4,84% |

| Pátria Renda Urbana FII (HGRU11) | 4,57% |

| Hedge Brasil Shopping FII (HGBS11) | 4,09% |

| VBI Prime Properties FII (PVBI11) | 3,42% |

Sector Breakdown

Documents

There is none

There is none

There is none

Tax regime

Trading Rules

Investment and Redemption Amounts

Investments can be made in lots starting from 1 share in the secondary market.

Cut-off Time for Investment and Redemption

As determined by B3’s trading hours.

Investment and Redemption Amounts

Investments can be made in lots starting from 20,000 units or in multiples of the minimum lot size of 20,000 units.

Investment and Redemption Method

Investments and redemptions must always consider that a “subscription or redemption basket” corresponds to a minimum lot of units, i.e., 20,000. Each subscription or redemption basket must be composed of at least 95% of its value in REITs from the FTSE Hedge Brazil All Equity REITs Index, in any proportion, and up to 5% of its value in Cash and/or Permitted Investments (at least one full basket).

Cut-off Time for Subscription Requests

Until 15 (fifteen) minutes before the close of B3’s regular trading session. Unitholders requesting a subscription through an Authorized Participant must complete the form “Unitholder Subscription/Redemption Request and Tax Exemption Declaration” and provide the respective Authorized Participant with brokerage notes and other documents required for the Administrator to determine the acquisition cost of the assets to be subscribed. The Authorized Participant must deliver the unitholder’s documentation to the Administrator at least 3 (three) hours before the close of trading on the Subscription Request Day. If the Administrator does not receive the documents within this timeframe, the subscription request will be canceled.

Cut-off Time for Redemption Requests

Until 15 (fifteen) minutes before the close of B3’s regular trading session. Unitholders requesting a redemption through an Authorized Participant must complete the form “Unitholder Subscription/Redemption Request and Tax Exemption Declaration” and provide the respective Authorized Participant with brokerage notes and other documents required for the Administrator to determine the acquisition cost of the units to be redeemed. The Authorized Participant must deliver the unitholder’s documentation to the Administrator at least 3 (three) hours before the close of trading on the Redemption Request Day. If the Administrator does not receive the documents within this timeframe, the redemption request will be canceled.

Asset Portfolio

Contact us

+55 11 5412 5400

contato@hedgeinvest.com.br

Investor Relations

ri@hedgeinvest.com.br

Sign-up for our Newsletter

© Copyright 2024 – Hedge Investments – All Rights Reserved

Hedge Investments Distribuidora de Títulos e Valores Mobiliários Ltda. ("Hedge DTVM") is committed to the highest ethical standards in all its activities. In order to make our best efforts to comply with applicable legislation, regulation, self-regulation and other internal and external standards, we have made this ombudsman channel available to provide agile, impartial, effective and independent assistance to clients who wish to review the solutions previously proposed through the primary service channels, including conflict mediation.

PRIMARY SERVICE CHANNELS

+ 55 11 3124 4100

contato@hedgeinvest.com.br

OMBUDSMAN PROCEDURES

Hedge DTVM has an Ombudsman Policy, with the purpose of defining the attributions of Hedge DTVM's organizational ombudsman component, which functions as a second instance service channel. 0800 761 6146

ouvidoria@hedgeinvest.com.br

Opening hours: weekdays from 10 a.m. to 5 p.m.

The service provided by the Ombudsman's Office is free of charge, and every service is recorded, archived and identified by means of a protocol number, which is provided to the applicant. The claim, the claimant's details and the service history are recorded and kept at the disposal of the Central Bank of Brazil for a period of 5 years. The deadline for responding to requests is up to 10 working days for a formal and conclusive response to be sent to the client, which may be extended, exceptionally and with justification, once for the same period. The Ombudsman's Office is responsible for finding solutions to the demands made by our clients and continuously promoting the improvement of our products and services. Its mission is to act as the client's representative in the institution, defending their rights, seeking a definitive resolution to complaints and proposing continuous improvements in the primary service channels and/or in the operational processes of the area involved.

The professionals who work in Hedge DTVM's Ombudsman's Office are duly certified by an entity of recognized technical capacity and report directly to the Ombudsman Director.

Hedge DTVM's Ombudsman prepares biannual reports containing the number of reports received, their nature, the areas involved in dealing with the situation, the average resolution time and the measures adopted by the institution, which must be approved by Hedge DTVM's Compliance Committee and kept at the disposal of the Central Bank of Brazil at the institution's headquarters, as well as on the website www.hedgeinvest.com.br for consultation by clients, for a minimum period of five years.

Cadastre-se

INFORME DE RENDIMENTOS – IR 2026 / EXERCÍCIO 2025

Prezado investidor,

O Informe de Rendimentos dos fundos de investimento administrados e/ou escriturados pela Hedge Investments será enviado para todos os cotistas até o último dia útil de fevereiro.

Informe Eletrônico

Os investidores que possuem e-mail na base da B3 (alimentada pelas corretoras dos clientes com base na informação de suas respectivas bases cadastrais) ou junto ao escriturador receberão o informe de rendimentos apenas por via eletrônica, em arquivo no formato PDF, com acesso com senha formada pelos 5 primeiros dígitos do CPF ou CNPJ do cotista.

Via física

Os investidores que não possuem e-mail cadastrado na base fornecida pela B3 ou junto ao escriturador receberão apenas a via física do informe de rendimentos, devendo observar o prazo dos Correios para recebimento.

Portal de Documentos

Também é possível obter as vias eletrônicas do documento acessando diretamente o Portal de Documentos da Hedge Investments pelo link https://portal.hedgeinvest.com.br. Caso ainda não tenha utilizado esta ferramenta, para realizar o primeiro acesso, o investidor deve seguir as instruções abaixo:

Passo 1: na tela inicial do Portal, clique em “Primeiro Acesso”;

Passo 2: preencha os campos com seus dados pessoais;

Passo 3: selecione seu endereço de e-mail, para o qual será enviado o código de autenticação;

Passo 4: digite o código de autenticação recebido;

Passo 5: defina a sua senha, a qual será utilizada também para futuros acessos; e

Passo 6: acesse o Portal de Documentos e visualize ou faça download de seu informe de rendimentos.

Informações cadastrais

Ressaltamos que, em alguns casos, o informe pode não ser recebido em função de dados cadastrais defasados, ou mesmo extravio. Desta forma, nossa recomendação é que o cotista com posição em bolsa mantenha suas informações cadastrais atualizadas junto à corretora em que possui a custódia de suas cotas, que é quem envia tais dados para a B3 e, consequentemente, para a administração dos fundos.

Cotistas que possuam posição direta junto ao escriturador devem entrar em contato pelos canais de atendimento da escrituração disponíveis no website da Hedge Investments.

Atenção – amortização parcial

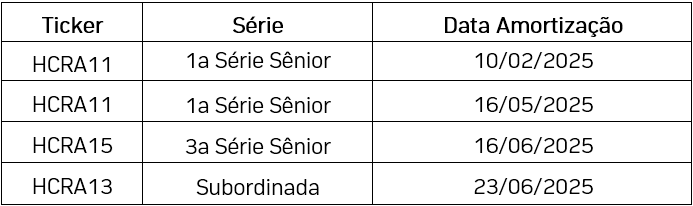

O fundo Hedge Crédito Agro Fiagro Direitos Creditórios teve amortizações de cotas parciais conforme abaixo:

O fundo Fundo De Investimento Imobiliário Memorial Office – Responsabilidade Limitada teve amortização de cota parcial em 11 de novembro de 2025.

Atenção – transferidos 2025

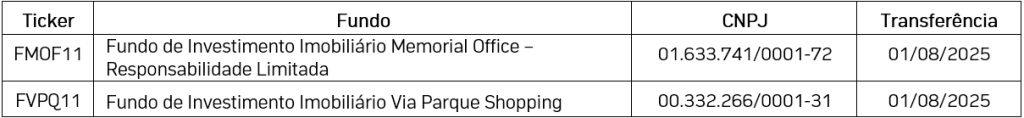

Os fundos abaixo relacionados tiveram sua administração transferida para a Hedge Investments durante o último exercício, portanto o informe enviado será referente apenas ao período sob nossa administração. O investidor receberá também um informe do administrador anterior, caso tenha sido cotista.

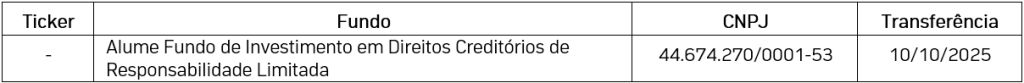

Adicionalmente, o fundo abaixo teve sua administração transferida da Hedge Investments para um administrador terceiro durante o último exercício. Assim, o informe de rendimentos enviado também contempla apenas o período em que o fundo esteve sob nossa administração.

Canais de atendimento

Caso tenha quaisquer dificuldades no recebimento ou acesso ao informe de rendimentos, entre em contato conosco através do e-mail informederendimentos@hedgeinvest.com.br, informando nome completo e CPF / CNPJ, ou pelo telefone (11) 5412-5490.

Atenciosamente,

Hedge Investments

HERT11: O primeiro ETF de FIIs de Tijolo do Brasil! Entenda tudo com o gestor da Hedge Investments